Future of E-commerce

- spochiraju

- Jan 25, 2020

- 4 min read

The economic liberalization in India in 1991 opened its markets to the world and around the same time, the Internet was opened for commercial use. And, there has been no turning back for both. Indian markets saw tremendous interest in the form of private and foreign investment, making India the 5th largest economy currently. Businesses have been opening shop online. In India, e-commerce started emerging around 2000 when the dot-com bubble was about to burst. Bazee was the pioneer in the online space but it was Flipkart, started in 2007, that set the stage for the explosion in the e-commerce space in India. The period between 2005 and 2010 saw the first wave of emergence of a number of online service-based businesses like MakeMyTrip, Naukri, IRCTC and many others which did not have any additional costs of delivery or logistics to be managed. The success of e-commerce startups in this phase led to exploration of inefficiencies in the offline businesses and innovation to plug those inefficiencies further fuelled the growth of e-commerce. Entrepreneurs started exploring newer, untapped areas in industries like, but not limited to, furniture rentals, home rentals, food delivery, fintech and logistics.

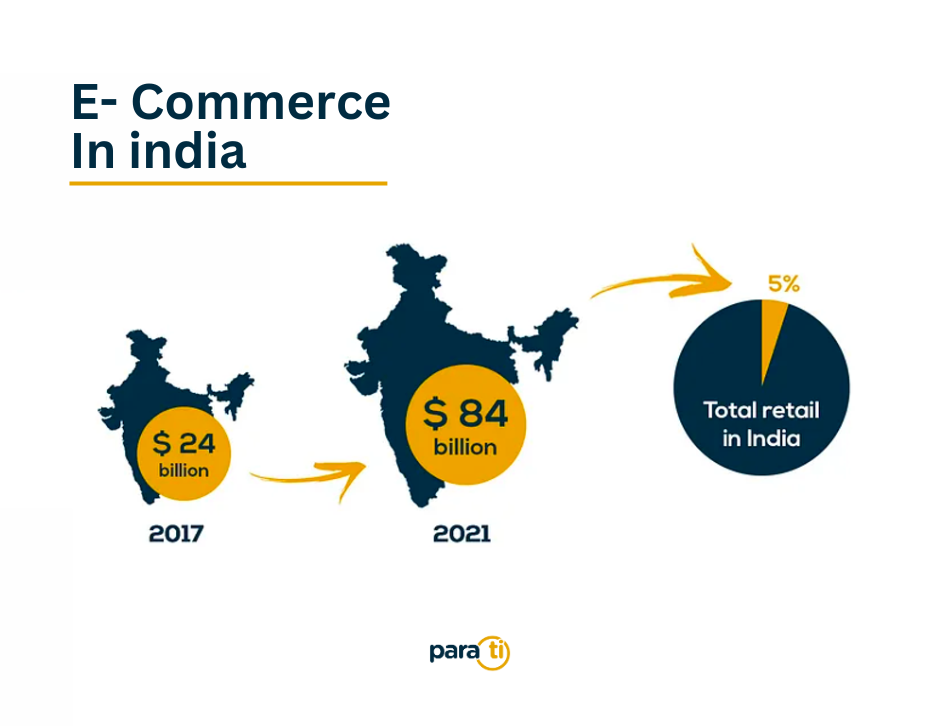

Today, e-commerce is booming in India. It is a huge industry with an enormous potential to grow. With the advent of e-commerce in India in 2007 and the number of advantages it presents to both consumers and businesses, it has been growing at a tremendous pace. According to a Deloitte report on Indian consumer and retail, e-commerce is expected to be worth USD 84 billion by 2021 from USD 24 billion dollars in 2017, growing at 34% CAGR. Even at these numbers and growth, e-commerce is a little less than 5% of the total retail in India. The overall Indian retail market is expected to grow to USD 1.2 trillion in 2021 from around USD 795 billion in 2017.

Favorable demographic dividend, no innovation and low organised penetration in retail coupled with unprecedented growth has made India as one of the most desirable retail destinations of the 21st century. India is the world’s third largest startup ecosystem having 24 unicorns in 2019, up from 17 in 2018. More than 1,300 tech startups were added in 2019. In 2019, the number of potential unicorns in India more than tripled from 15 to 52 in 2019. Nasscom president Debjani Ghosh estimates that Indian unicorns can increase to 95–105 by 2025.

Last two decades have seen tremendous changes in the retail industry. The modern retail is vastly different and highly fast-paced than traditional retail. Indian conglomerates and industrialists have invested heavily in retail to launch multi-brand retail. Consumers are fickle-minded. They know what they want and want only that. This has led to short product life cycles and there is an urgent need to continuously update inventories and provide something new to the customers to keep them engaged and increase repeat business. Modern retail is still evolving and businesses are trying to figure out what consumers want. More and more offline retailers are jumping into the e-retail space to increase their presence and serve more customers. Similarly, e-tailers are opening brick-and-mortar stores to provide a better experience to the customers and have an actual consumer touch point. There is an increasing focus and growth to create omni-channel commerce to grab a larger share of the consumer’s time and money, which might be one of the reasons for Amazon buying equity stake in Shoppers Stop. The entire objective of creating an omni-channel commerce model is to better understand and own the interactions between experiential and transactional.

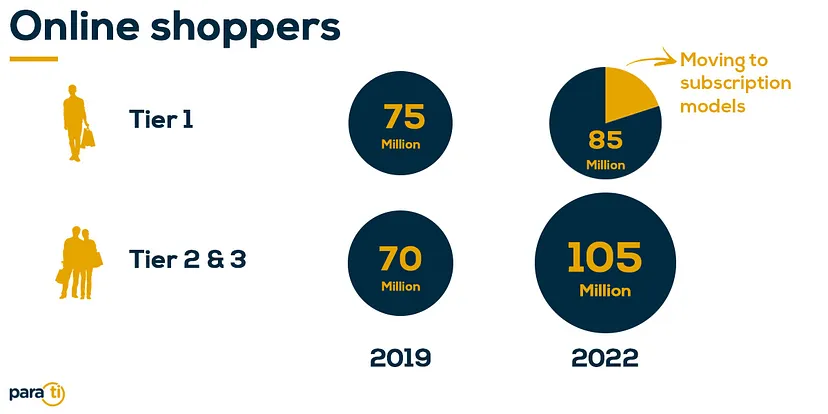

In the past decade, the growth in e-commerce primarily happened in the Tier 1 cities. Companies have started tapping into the much under-served market in Tier 2 and Tier 3 cities. The consumers in these markets have started accepting the online shopping model. Businesses are innovating to solve the challenges of vernacular content generation, affordability and reach to capture this market. With the trickling down of business happening from Tier 1 to Tier 2 and Tier 3 cities, consumers in tier 1 cities are looking for newer and better avenues to hook on to.

Consumers in tier 1 cities now look for value instead of just price. They want products tailored to their needs and specifications. There is a greater focus on selling something worth buying. A shift is happening from inventory-push model to inventory-pull model. The next wave of growth in e-commerce in tier 1 cities will come from businesses who understand the consumers better and are able to serve their needs better. Businesses are sitting on huge mounds of consumer data waiting to be analyzed. Almost every big company now has an analytics team to generate insights and leverage the data that they have. Personalisation and subscription are the answers today to generate customer stickiness. Personalisation, on the one hand, will increase customer engagement by providing them with relevant and better-suited products instead of generic or unwanted ones, while subscription will help increase customer loyalty and lifetime value for the businesses. This will also help in producing and stocking goods which businesses are better able to sell, thereby, reducing their losses. Personalisation will be the new standard instead of just being a trend.

Just by nature, retail and e-commerce are ever expanding because of increasing population and higher incomes. But, e-commerce will continue its much rapid upward trajectory both by capturing the untapped markets as well as by innovating and providing the matured markets with better and newer services. Businesses of today who embrace the change and innovate will remain relevant tomorrow. Parati aims to leverage user preferences and data to drive product recommendations while aggregating clothes from across platforms. We want to serve the online shoppers of tomorrow by understanding them well as consumers and providing them with a personalized shopping experience. Our app is live on play store. Download here.

Comments